The GATENet Vision.

The GATENet Vision.

Our founders have a wealth of collective experience within some of the most senior positions available in the capital markets. They came to the conclusion that the current Financial Market Infrastructure (FMI) needed an overhaul, to reduce barriers to entry, free up locked capital and create greater efficiencies that would ultimately replace the risk laden system that operates today.

GATENet is the culmination of that vision, it replaces the current legacy framework with a revolutionary blockchain-based, financial markets infrastructure (Digital FMI) FMI, to enable T-Instant settlement solutions in a fully prefunded model.

Mark Mariampillai, GATENet CEO

GATENet offers a revolutionary alternative to the current legacy systems within the capital markets. The GATENet team is committed to the transformation of today’s Financial Market Infrastructure (FMI), working from the ground up and rebuilding a digital model that benefits everyone. Our collaborative approach with industry leading partners offers the greatest opportunity for adoption, and allows GATENet to be a dynamic solution for global finance.

Why GATENet Is Different.

GATENet’s Digital FMI is organized around a single source of final legal balances created at the point of trade when settlement finality takes place simultaneously on a T-instant basis. The GATENet T-instant model will eliminate credit, counterparty and replacement cost risks; fails will disappear; capital currently deposited with ‘Clearing and settlement houses/CCP’s(Central Counterparties) will be unlocked; pan-jurisdictional liquidity pools will be opened; clients and issuers will be reconnected and the hidden unaccounted risks of intermediary insolvency removed the functionality on multiple protocols.

GATENet will interact with the exchanges it supports and multiple blockchain protocols, providing optimal flexibility and interoperability. GATENet, in parallel, is designing and developing its own proprietary permissioned blockchain for financial markets (using Hyperledger Fabric), comprising on chain CSD functionality enabling dematerialisation, securities settlement and securities maintenance, which ultimately will co-locate in the ATS delivering true immutability in real-time, simultaneous with trading guaranteed in contract. Once tested and proven, GATENet will seek to replicate the functionality on multiple protocols.

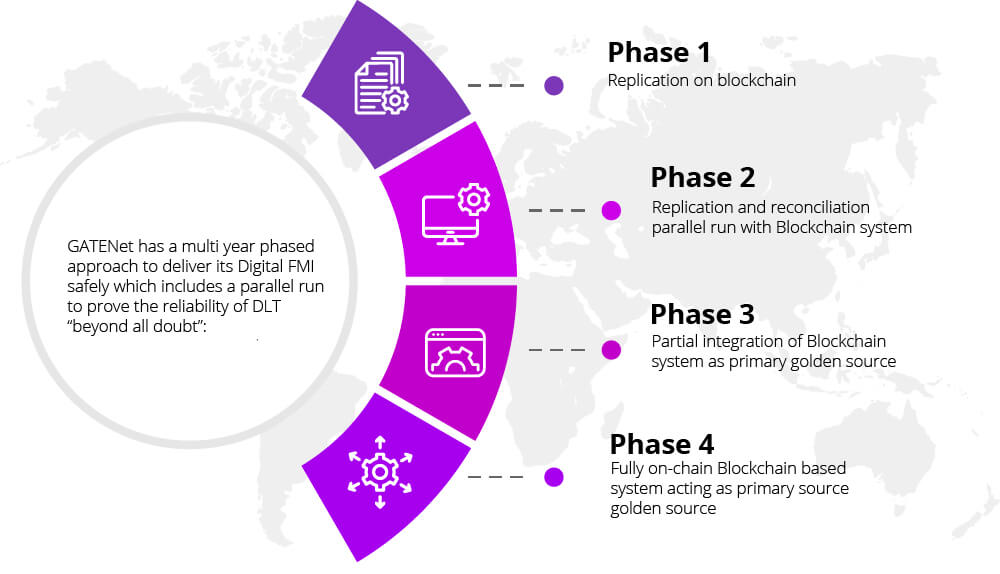

Our Phased Approach