Index

Welcome To GATENet's Digital FMI

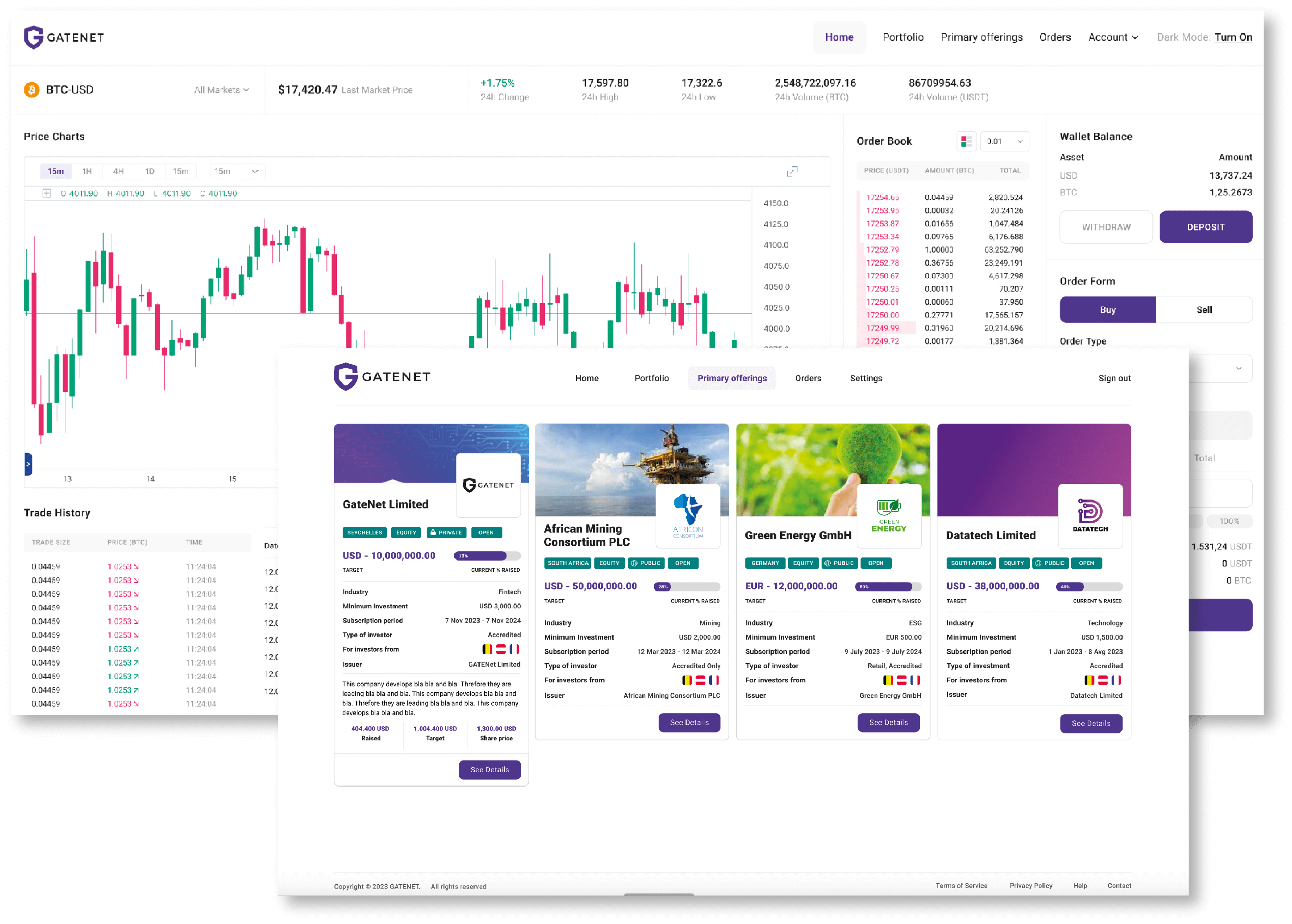

GATENet offers clients a turn-key solution for digital securities & digital assets from Primary issuance to secondary trading, including clearing & settlement finality, meaning when you trade, you settle - T-Instant.

Support Your Capital

Raising Ambitions

Reduce Risk and the

Cost to Market

Access Global

Liquidity Pools

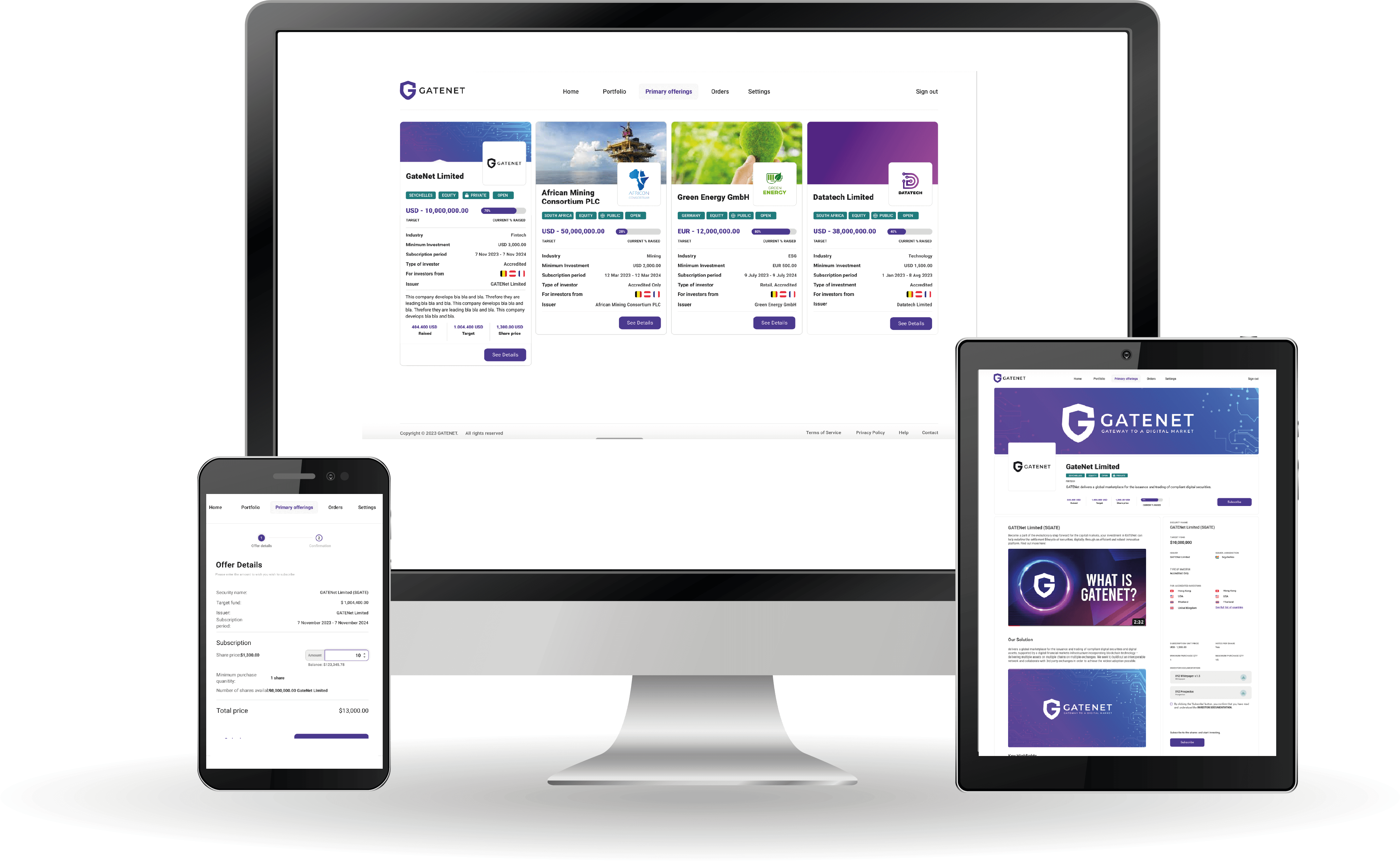

Primary Issuance

A primary issuance platform that delivers all aspects of the token issuance journey. Raise capital without the traditional barriers to entry within a robust and comprehensive system that has been built from the ground-up with securities regulation and compliance in mind.

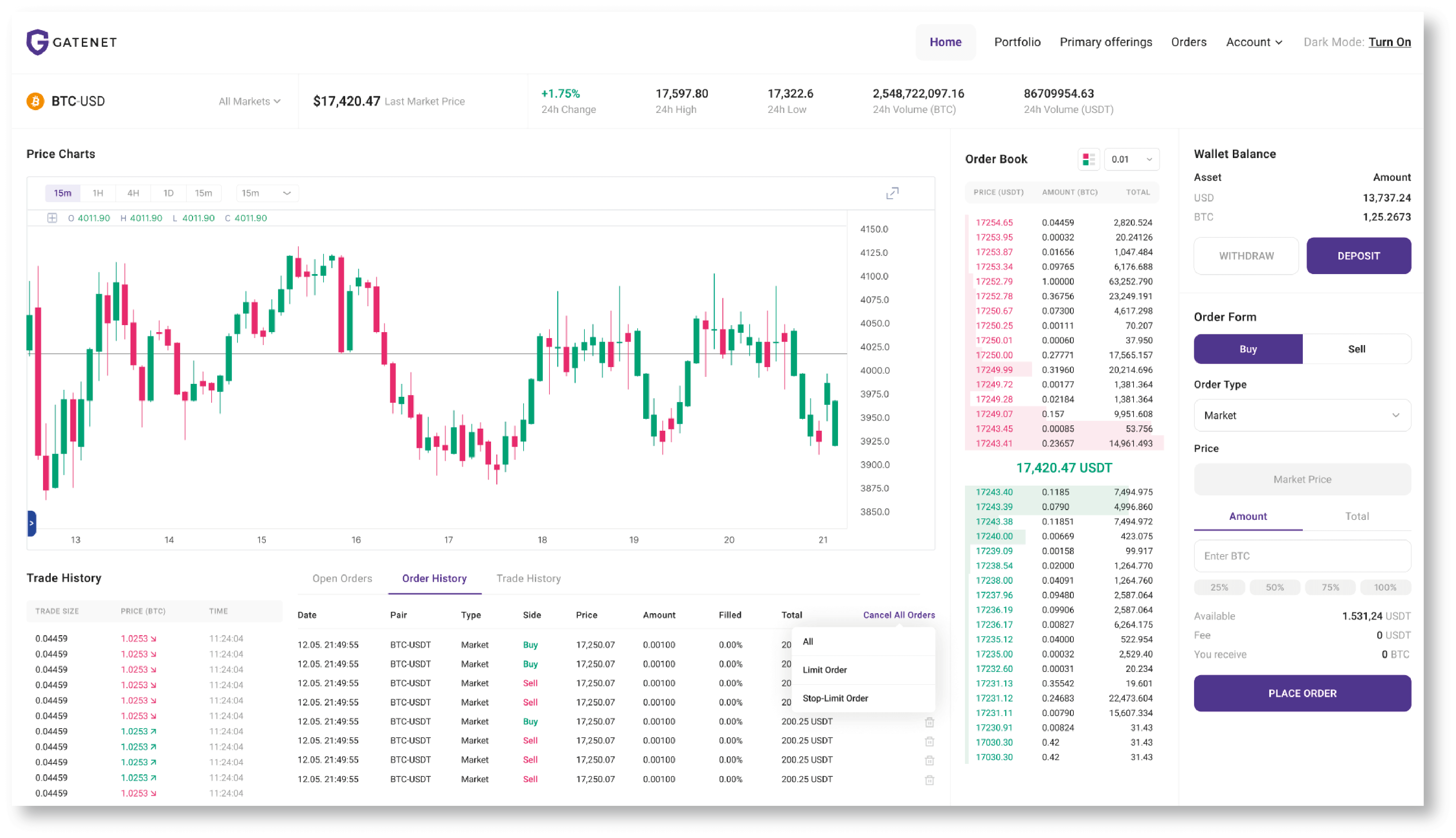

Secondary Trading

GATENet’s platform enables clients to whitelabel our comprehensive Alternative Tradings Software (ATS) and Central Securities Depository (CSD) technology. Trade digital securities (native & non-native), digital assets (including cryptocurrencies and stablecoins) all within a regulatory enabled T-Instant environment.

Our Partners

We have partnered with a range of world leading technology

developers and Subject Matter Experts (SMEs) to execute the T-instant

vision, housed within an all-inclusive platform, GATENet.

Our T-Instant Solution

Settle any trade using GATENet’s Digital FMI solution instantly, with instantaneous transfer of ownership. We break away from the legacy T+2 model, and have delivered a unique real-time settlment technology solution.

Multi-Chain Interoperability

GATENet will interact with the exchanges it supports and multiple blockchain protocols, providing optimal flexibility and interoperability. GATENet’s combination of high-performance trading engines, central securities depositories/registry technology, surveillance and of GATENet’s Digital FMI, interfaced to current infrastructures, creates an integrated solution that provides a multi-chain, multi asset platform to be used by the GATENet global network.

Real World Assets (RWA), Redefined

GATENet’s primary offering covers the entire equity issuance lifecycle from asset set-up within the Central Securities Depository (CSD) through to configuring the offering within the front end GATENet Primary Issuance Platform (PIP) with relevant prospectus/offering document and documentation for prospective buyers to view and subscribe to an offering.

Entire Inssuance Journey On One Platform

Customisation for Issuers

Asset creation via Digital CSD

Secondary Trading functionality

Tradable Assets Types

‘Native’ Securities

Securities issued originally in tokenised form

‘Non- Native’ Cryptocurrencies

publicly listed securities admitted to trading on another market or private securities which we wrap into sponsored or unsponsored Tokenised Depository Receipts (TDRs)

Cryptocurrencies

Crypto pairs (BTC, ETH, etc and utility tokens)

Fiat Currencies

Tokenised fiat pairs as tradable instruments and as settlement currencies (Tokenised Currency Receipts (TCRs)

The DFMI Model

The current Financial Market Infrastrcuture (FMI) is outdated, costly, step for the capital markets, redefining the issuance, trading and settlement lifecycle, with our innovations in technology andutilsing blockchain, we’re bringing about a new era in global finance.

Reduce cost and complexity

Freeing up locked-up capital, reducing barriers to entry and back-end complexity that supports institutions and the end user

Eliminate failed trades entirely

Millions are lost each year in failed trades costs, in our fully-funded environment there are no failures. When you trade, you settle.

Remove counterparty risk

Simultaneously unlock capital and overheads from the post-trade processes by eliminating counterparty risk, rather than just managing it.

Public and Private markets

Provide facilities for both public and private markets.

Delivering a T-instant solution

A pre-funded model providing simultaneous, final, irrevocable, trading, delivery versus payment. Settlement finality at the time of a trade (“when you trade you settle”).

Empowering investors & issuers

Provides the functionality, for direct market access, native and FIX API or utilising our intuitive GUI.

Increase market efficiency

Providing a streamlined market infrastructure model that reduces the number of intermediaries.

Eliminate compliance risks

No manual processes, data duplication and human bias which are prone to error and operational risk.

Providing Settlement Finality

Digital securities, digital assets (cryptocurrencies, stablecoins), digital fiat representations.

A Tailored Solution

GATEet’s can provide bespoke strategic technology solutions to our clients who seek tailored digital marketplaces. Our turn-key solution centres on our ability to provide a full range of services and a deep understanding of traditional asset classes combined with new technologies, we can support our clients and partners at every stage of a project creating a single point of access to support the issuance, listing, trading, settlement, registry and custody of digital assets (digital securities, digital fiat currencies and crypto) - GATENet’s Digital FMI.

Latest News